Mr. and Mrs. Unlucky – Understanding Sequence of Return Risk

Since March 9th of 2009, the U.S. stock market has taken off. Some have labeled this the longest bull market in history although FINRA technically gives that title to the 12 ½ years from October 1987 – March 2000. Many investors have reaped the benefits from strong equity markets over the last 9 years, but know the economy and markets are cyclical. What if the next decade isn’t as friendly to our bottom line? This question is especially relevant to retirees starting to withdraw from their investments to generate income. Understanding the impacts “sequence of return risk” can have on the life of one’s assets can be imperative to the success of a financial plan.

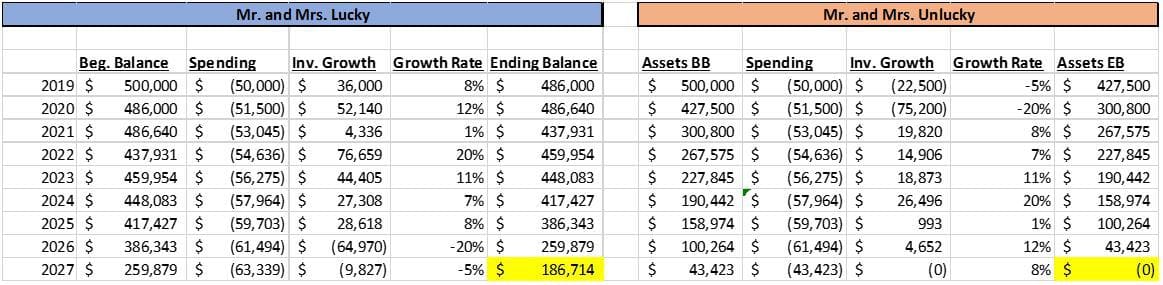

“Sequence of return” risk is the threat of adverse return orders, particularly in the early years of retirement. The attached table shows it is possible for two couples to have the same average return with very different results.

Both the Lucky’s and Unlucky’s have beginning retirement balances of $500,000, a $50,000/yr spending need inflated annually at 3% and an overall average return of 5%. The only difference is the order the returns occur is the exact opposite. In this scenario, the Unlucky’s portfolio would be spent down to zero in only 9 years, while the Lucky’s would still have $186,714 remaining.

There are a variety of ways to hedge against “sequence of return” risk. Crafting portfolios with a more conservative asset allocation is arguably the most popular tactic. Let’s face it, there’s a reason most financial advisors don’t have their retired clients in 100% equity portfolios. It’s too risky. More balanced portfolio’s containing a 50/50 or 40/60 split of stocks to bonds can help smooth the ride in volatile markets. You may not reap the highest highs, but you’ll likely avoid the lowest lows.

Monte Carlo analysis also addresses sequence of returns. Monte Carlo’s often run 1,000 or more simulations, accounting for good markets, bad markets and everything in between to calculate a plan success rate based on the clients’ goals. This type of statistical analysis is widely accepted by academics and has proven much more reliable than the straight-line method.

Speaking of academics, William Bengen’s “rule of 4%” states that one can initially withdraw 4% of their assets – adjusting annually for inflation in subsequent years – and expect to not run out of money in a 30-year period. Fortunately, this rule is more of a guideline, as many retirees require higher withdrawal rates to meet their specific goals. Nonetheless, the “rule” can provide valuable perspective when deciding on retirement lifestyle expense.

Given the choice, we’d all prefer to be Mr. and Mrs. Lucky. The problem is, we can’t choose – or even predict – what the markets are going to do or when. What we can choose is to actively engage ourselves in the financial planning process and meet regularly to discuss life changes and market changes as they occur.